Insights from our February COVID-19 response

1 Apr 2021

Why we publish monthly data on our COVID-19 related service delivery

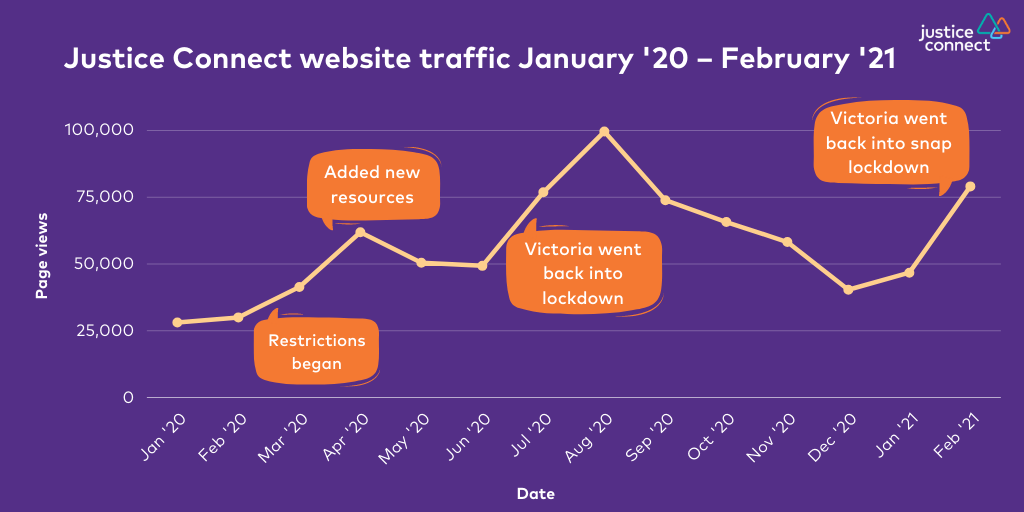

It’s now been 10 months since we launched our targeted response to COVID-19 related legal problems for individuals. In that time, we have used an agile approach to the design and delivery of our legal services. We’ve analysed our data and surveyed what legal problems people are encountering, so that we can improve our services, resources and digital outreach. We share these insights with the sector so others can benefit from our real-time trends and insights, and to support further collaboration.

This will cover the period from 1 – 28 February 2021. Take a look at our Fair Matters blog for reports from previous months.

What key events happened in February?

There were three significant events in February that impacted how people accessed our services and resources.

1) Victoria entered a snap 5 day lockdown on the 17 February to prevent the spread of coronavirus during the Holiday Inn cluster. As a result, page views to our resource on the Victorian Government’s emergency powers rose from 8,411 in January to 12,619 in February. We regularly updated this resource with the latest information from the Victorian Government and pushed out the resource via social media and search engine ads. 50% of people that found this resource through search engines, confirming what we have already discovered that many people use search engines as their first port of call when looking for legal help.

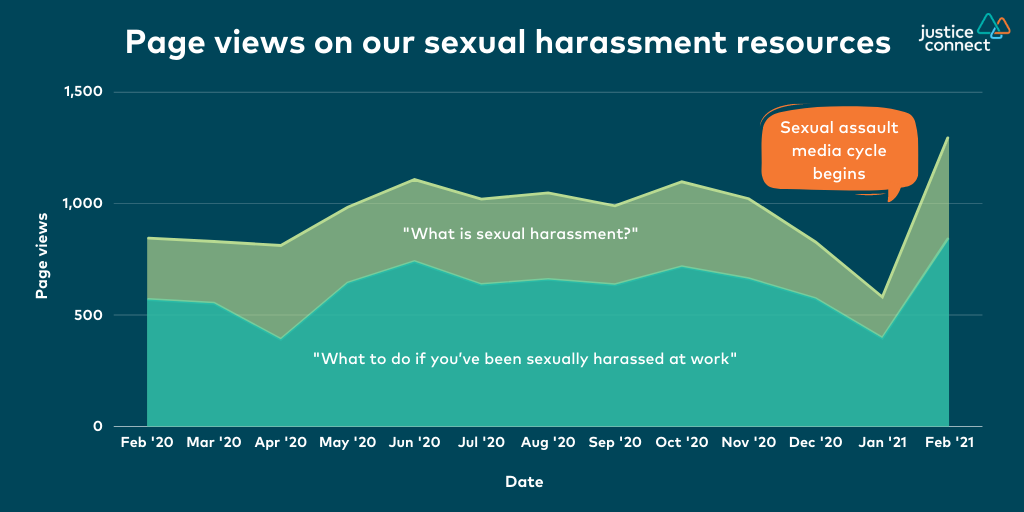

2) A strong focus on sexual assault entered the media cycle due to two high-profile cases in Federal Parliament. We saw a record number of people accessing our resources on sexual harassment in February (as well as a 140% increase month on month).

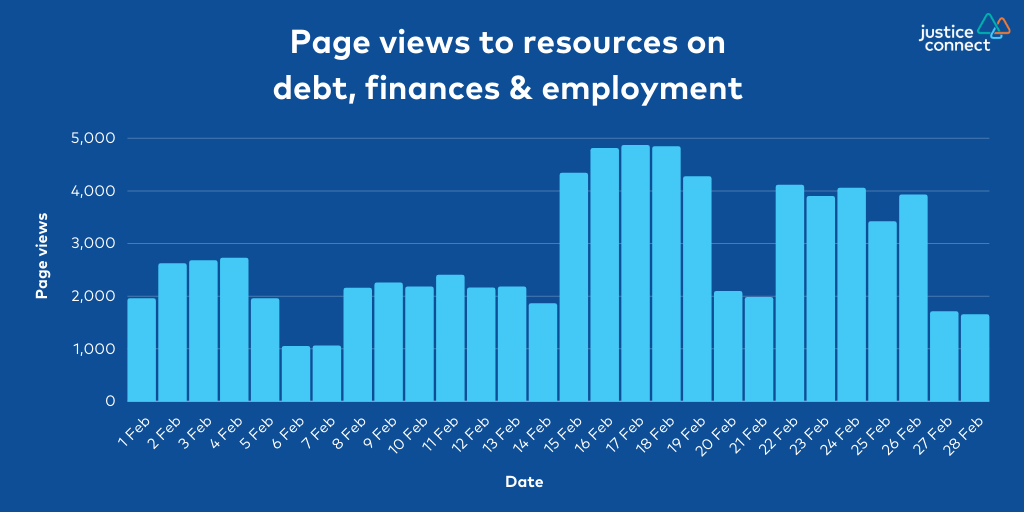

3) On 24 February, the Government decided to cut JobSeeker to around $44 – well below the poverty line and the increases introduced in response to COVID-19. In correlation, this month there was a noticeable increase in people accessing our resources on managing debt, financial troubles and employment issues.

Our data on demand for legal help in February

We had 26.8K unique visitors to our website in February, who collectively viewed close to 80K pages on our website. We saw the average pages visited per session climb from 1.6 in Jan to 2.3 in February. People were also spending 4% longer during their session.

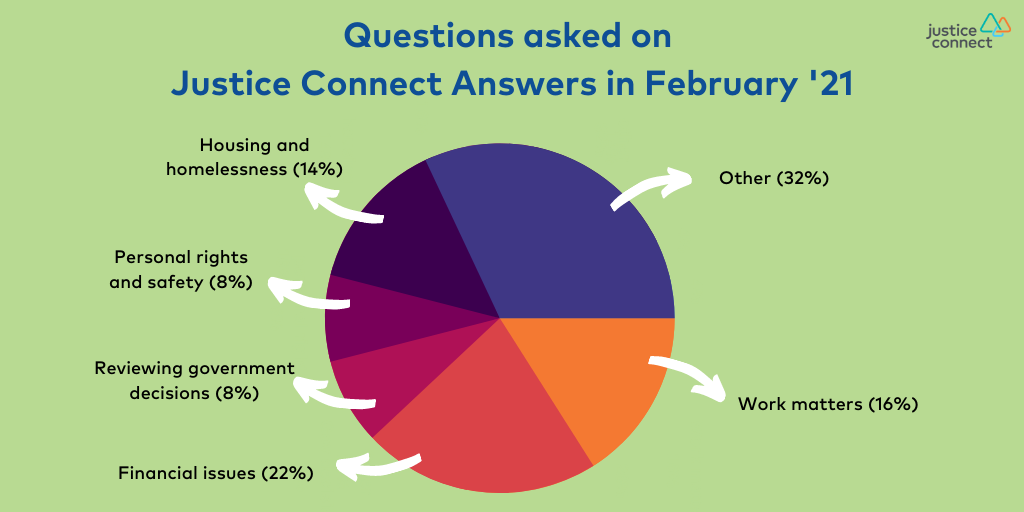

Over at Justice Connect Answers, our free online legal clinic available to people needing answers to their simple legal questions, over one fifth of the 37 questions submitted were related to financial issues. Questions about work accounted for 16% (up from 11% last period).

Our Homeless Law service had a total of 82 enquiries; 51 of which were tenancy related. We also experienced an increase in enquiries made to our Domestic Building Legal Service, up by 58% from the previous month.

How people found and used self-help resources

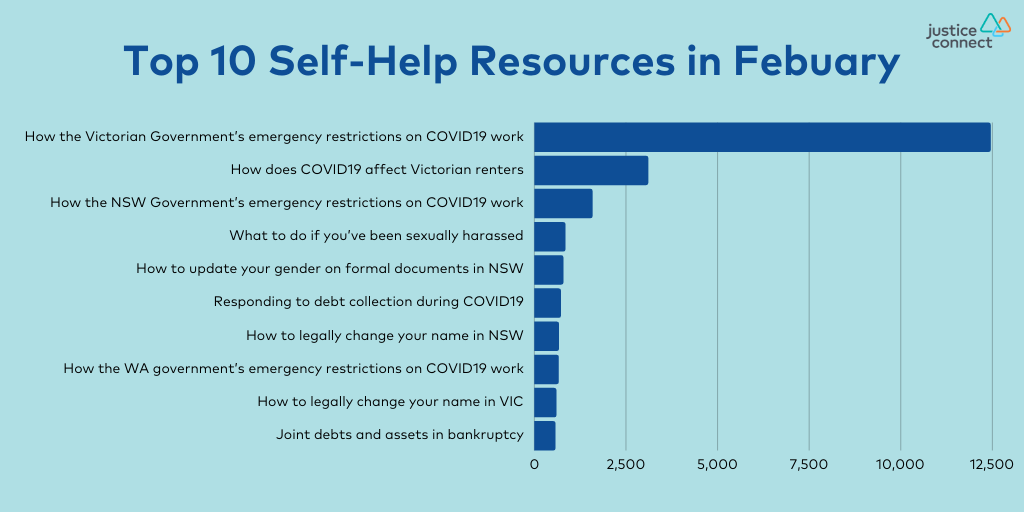

As mentioned above, the Victorian snap 5 day lockdown contributed to the large spike in views to our resource on COVID-19 emergency powers in Victoria. In fact, 47% of all pageviews for our self help resources were to our various emergency powers resources (three of which – VIC, NSW, and WA – appear in the top 10 list below).

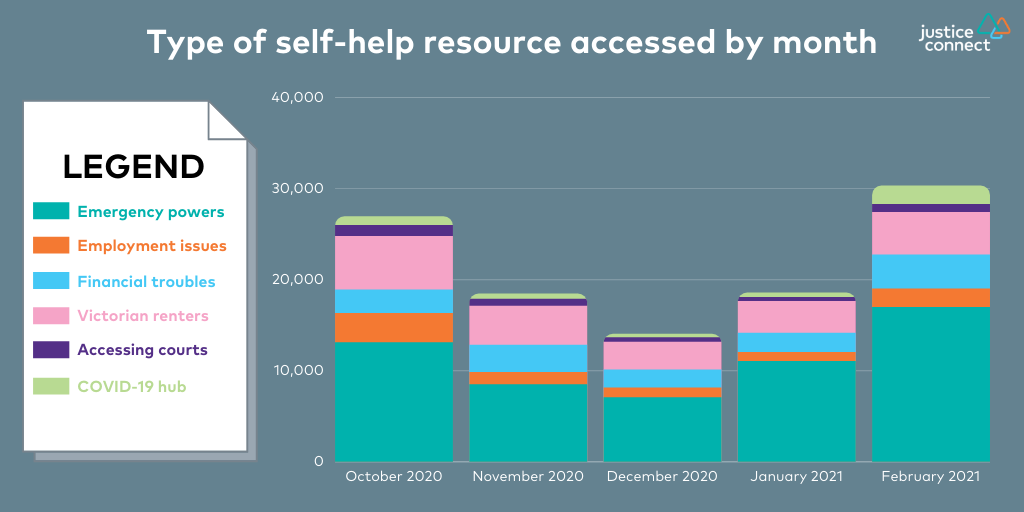

When analysing the various categories of self-help resources that people accessed in February, we can see that most categories experienced a boost. We believe this corresponds with our increased focus on digital consumer outreach, particularly through paid advertising on social media and search engines. In particular, the resources for Victorian renters (shown below in pink) have grown significantly, likely due to the impending changes to the Victorian tenancy laws.

Which people are visiting Justice Connect?

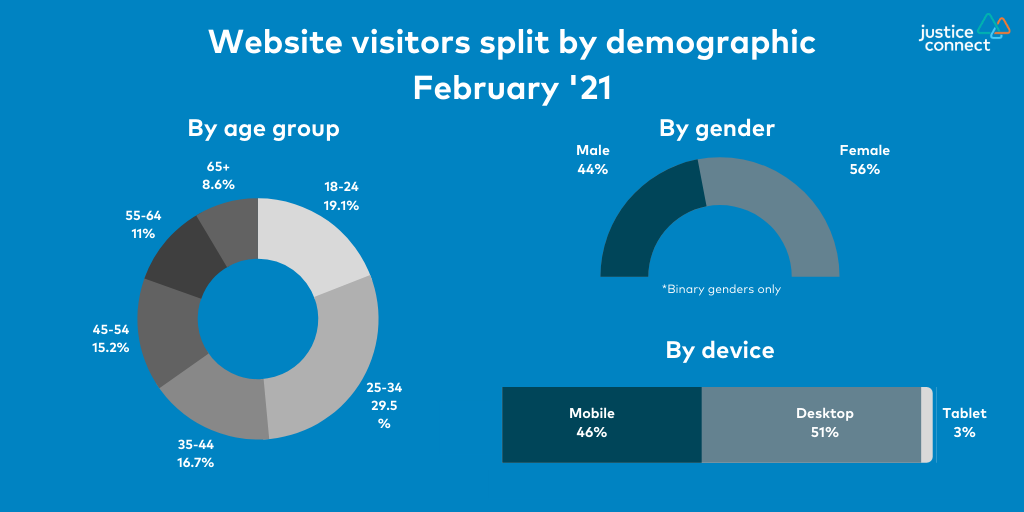

In February we noticed an increase in female users on our website (making up 56% of identifiable binary genders). Female visitors were more likely to be looking at resources about sexual harassment, Dear Landlord, pages about our services (Not-for-profit Law and Homeless Law in particular) and other key Justice Connect pages (about our team and board, and working with us).

In comparison, males were more likely to be looking at our emergency powers resources, and resources about debt collection.

Dear Landlord: a self-help tool for Victorian renters

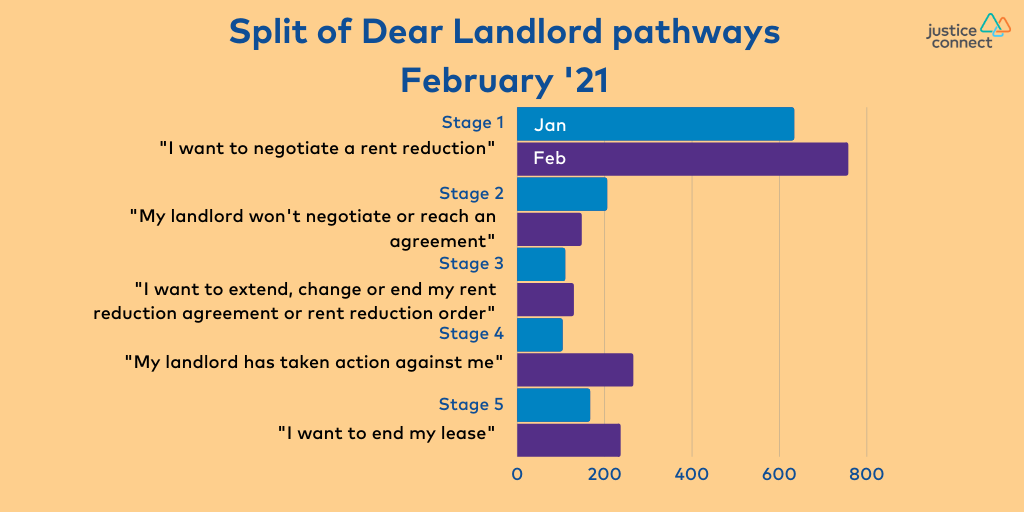

Visits and uses of our Dear Landlord tool have been increasing significantly since December and January, reaching up to 6,812 page views in February. This was our second highest month for page views since launching the second version of Dear Landlord over one year ago. We expect this was due to our increased digital consumer outreach efforts in the lead up to the 28 March Victorian tenancy reforms.

Within Dear Landlord, there were more people accessing stages 1, 4 and 5 (“I want to negotiate a rent reduction”, “My landlord has taken action against me” and “I want to end my lease”). Our outreach was focusing on ensuring Victorian renters knew they could still negotiate rent reductions and apply for the $3,000 rent relief grant up until 28 March, which many people did not know.

How we’ll apply these learnings moving forward

The COVID-19 protections have ended from 28 March and new laws are in place, so we have shifted our approach to educate people on what the new rent arrears laws mean, including the ‘5 strikes’ approach, as well as the COVID-19 transition regulations for enduring rent reduction agreements/orders and VCAT applications.

We are particularly concerned for:

- women and single parents who have been most impacted by COVID-19 related financial hardship and job insecurity; and

- people in regional areas who are facing increasing rental rates and decreasing housing option due to more demand for regional rental properties during the pandemic.

Further, with rent increases no longer banned, landlords will be free to raise rents. Many will likely do so, given many landlords have also experienced financial hardship and will be looking toward their own financial recovery.

After many rounds of user testing and prototyping, we have launched a third version of Dear Landlord after making changes according to the new rental laws and prospective users’ needs or feedback.

Another area we will be focusing on is legal problems arising from debt and bankruptcy, and claiming wages owed by an employer that is no longer trading. This is largely due to recent data from the Australian Bureau of Statistics that uncovered 41% of businesses reported cash on hand could cover less than 3 months of operation.

Looking for more insights on legal service delivery? Subscribe to our mailing list to stay connected with us.